This essay expands on the subject already addressed by Ascanio Graziosi in his interview with World Geostrategic Insights, “A New Model for Financing Investment in Africa“, which took up Graziosi’s theory centred on the redesign of interventions in favour of the poor people and business as well. The theory has been published the first time eight years ago in the eBook Financial Inclusion and revisited in 2019 in Poverty – An Alternative Paradigm,

By Ascanio Graziosi – Development Economist & Publicist

Last century the Populists launched the microfinance idea on the assumption that it was the right way to fight poverty. Both desk research and field activities proved that it has been a wrong approach.

Moreover, the Populists have been wrong about the modalities to make the inclusion happens and indeed they: a) assigned to the lender the task to fight poverty, which is a GVT duty and responsibility, b) mystified the concept of credit that means confidence and, more important, c) neglected to inform that credit must be managed by Professionals.

As a result, unskilled and greedy finance providers along with low profile politicians entered into the credit market wiping out the difference among Lenders, Developers and Philanthropists.

The financial establishment and the media sustained and inflated the Microfinance’s movement before evidence. This happened because the Governments did fail to fight poverty, despite the billions of hard currencies injected in the field; at that time, it was considered important to go via credit, the move being in line with the dominant role of the financial component in the economy. It is worthwhile to note that old-fashioned microfinance’s idea has nothing to do with the current vibrant microfinance sector including hundreds of Units working close to the Communities and upgrading their position in an open and interconnected market.

Eventually, in 2010 Basel Committee on Banking Supervision published a document (http://www.bis.org/publ/bcbs175.pdf) that has been a reference in point to regulate the uncontrolled microfinance market. Then, between end 2015 and beginning 2016 both the Bank for International Settlements (Basel III) and the World Bank-CGAP phased out the microfinance idea proposed by the Populists.

However, despite the progress achieved to bridge the poverty gap, day by day, people perceived that there was something wrong in their life whether they were ordinary people dissatisfied with the environment, or professionals and entrepreneurs involved and committed in the system.

Currently, there is a wide consensus from Academics to Practitioners who endorse the idea to have the countries’ development via inclusive growth where each one and every Actor should be committed under the flag of Private and Public Partnership and applying the holistic approach.

The dissatisfaction has found echo with the Big Finance Players and the World Bank in the annual meetings (October 2018) admitted the difficult task of positioning itself at the forefront of the world’s most urgent issues; in the same understanding, the European Commission admitted “complex challenges in the world around us, ranging from poverty conflicts and migration to climate-change and demographic challenges”.

We went through the voluminous narrative on development finance and borrowing from our extensive field experience have concluded that the poverty’ interventions approach should reinstate the true concept of credit based on viability and sustainability and reduce the dominant role of finance in the economy.

To make the reasoning short, we do say that with a remunerated job and/or providing opportunities, people can make a choice in freedom and independence. The finance leverage is important and even vital, of course, but shouldn’t be overvalued and should meet the needs of the real economy.

As a matter of statement, 2016 has been the year of handing over the stick from Millennium Development Goal (MDG 2000-2015) to Sustainable Development Goals (SDGs 2016-2030).

In our vision, to have a whole picture of global finance, the starting point is to look at the increased “financialization of the economy”, or too much liquidity floating in search of offshores instead of being invested in the real economy.

The capitalism has produced too much Finance and less Economy; in other words, the degeneration of the economy’s financial component hasn’t produced a real wealth, but virtual affluence. Capitalism won the battles against Communism but lost the war against poverty and collapsed with the financial crises in 2007-08 and then globalisation proved the wrong way of doing business, although promoters had good intentions.

By and large, the disruption in 2008 has been originated by two main facts: (A) the violent and greedy way to accumulation; (B) the dominant role of the financial component of the economy.

The algorithm that has been at the heart of the capitalism, explicitly the exploitation of the natural and human resources hasn’t been no more accepted by the people; the accumulation has been replaced by the solidarity to get included an ever-increasing number of people. However, the supporters of the solidarity idea haven’t yet proposed a new algorithm.

After Lehman Brothers’ bankruptcy in 2008, we haven’t noticed any significant changes in the financiers’ behaviour and the related narrative doesn’t mention any tangible revision: we aren’t alone saying that. In an interview, Christine Lagarde, MD of International Monetary Fund said: “After ten years from Lehman Brothers default the finance system changed a little bit” This isn’t a lonely voice and if at top level they said that we must believe them.

We do think that the investors/capitalists’ behaviour won’t change overnight; under the circumstances, there is a long journey ahead for true inclusion. What to do? In this context, proposing new rules of the finance game could be useless. Borrowing from our experience in the emerging economies, we have observed that the Poverty issue has been incorrectly addressed and the need to change the Paradigm.

MOVING FROM CREDIT-BASED ECONOMY TO COMMUNITY-BASED ECONOMY

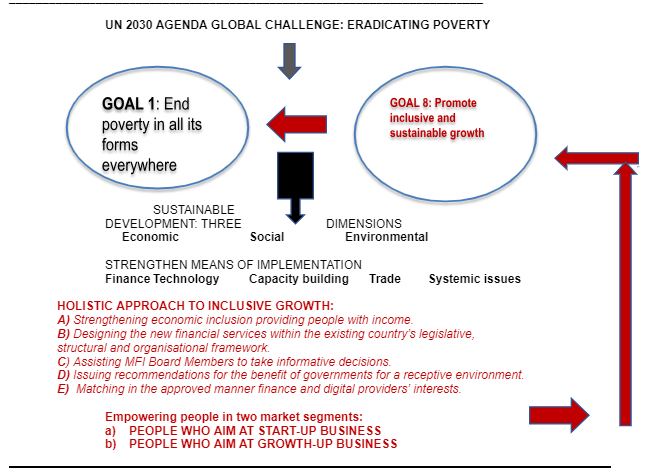

In this understanding we worked out an Algorithm that has been inspired by the UN 2030 Agenda which consists in reversing the approach from Bottom to Top in a more comprehensive methodology moving from Credit-based Economy to Community-based Economy.

How to achieve it?

– To have in place a country’s appropriate economic policy along with a receptive environment for investments.

– To conjugate together financial and economic inclusion, countries’ inclusive growth being the goal, as per UN 2030 Agenda for SDGs.

– To establish a national Investment Fund in each country/region or having private capitalists in the Development Agencies’ Board Rooms, providing fresh resources.

– To have Banks, Micro Banks, Investors, Development Agencies, and any suitable provider ready to partner with above-mentioned Fund and work as a driven belt between the Investors and Entrepreneurs for Start-up and Growth-up Business.

– To have in place a suitable decision-credit model that has sustainability as a core business along with the respect of eligibility criteria via a correct and detailed market segmentation.

– To have digitalisation of services/products sustainable for the providers, affordable for the users and market transparent.

– To have in field a clear and distinct role among Lenders, Developers and Philanthropists, which have different sources of capitals and distinctive management criteria.

The proposed Model aims at redesigning the entire architecture of financial inclusion, to mitigate poverty via jobs creation and providing opportunities in view of improving people’s life conditions and business growth. It has been proposed eight years ago in the eBook Financial Inclusion and then revisited in 2019: POVERTY – An Alternative Paradigm, https://www.morebooks.de/store/gb/book/poverty-an-alternative-paradigm/isbn/978-613-8-45817-3.

As a matter of fact, in the field there are UNSERVED & UNDERSERVED ENTREPRENEURS, UNDERCAPITALISED LENDERS, UNSATISFIED BENEFICIARIES and the question is how to assist them to achieve a common objectives and interest.

In this comprehension, there isn’t any other chance, but to play with the cards distributed by the big financial players. Consequently, we have elaborated on what the establishment has recommended, which is centred around two fundamental pillars: sustainability and inclusion.

The Model paves the way to put finance providers in the picture of the guidelines provided by the UN AGENDA FOR SDGs and to find out a suitable solution to facilitate the access of the entrepreneurs to the source of capitals and meet people’s demand for needed services (see below Figure).

Figure – Inclusive growth via business approach.

To approach the market and manage interventions referring to thousands of people, we may distinguish four big market segments (see Box): in the segment (a) the financial provider is in presence of food aid, in the segment (b) we have income generating activities, while in the segments (c) and (d) the finance provider deal with enterprise promotion and development.

Box – Market segmentation

Empowering people in four big market segments:

|

Source: https://www.amazon.com/kindle/dp/B01ENJP37S/ref=rdr_kindle_ext_eos_detail

Finally, we don’t say to restore the Keynesian theory; we do say:

a- To mitigate the financial way to development, too much based on the provision of the financial services to the detriment of the real demand for and reverse the approach from the bottom to the top.

b – To shift the paradigm from an over-indebted economy at micro and macro level to a real people’s empowerment through durable jobs creation and opportunities’ promotion.

c – To have private investors really involved in the development process.

d – To use the financial leverage for sustainable interventions, which is as easy to say as difficult to achieve, because ask for a revision of the decision-making process and fulfil the eligibility criteria.

e -To digitalise the services with a product that is sustainable for the providers, affordable for the clients and market transparent: this can be reached with an appropriate market segmentation: https://www.linkedin.com/pulse/open-letter-fintech-ascanio-graziosi/.

f – To conjugate together the seventeen Goals of the UN 2030 Agenda for SDGs and in particular the Goal 1 (End of poverty) and Goal 8 (Promote inclusive and sustainable growth).

What about the poor people?

On the matter, we found interesting what Mr Elumelu’s, a Nigerian banker & tycoon said in an interview, in 2014 (quote): “But we have come to realise that there are better ways of impacting a huge number of people through business practices, not necessarily philanthropy”.

In our view there are parallelisms of the above statement with the Creating Shared Value theory that M. Porter and M. Kramer (Harvard Business School) proposed a couple of decades ago. The authors have criticised capitalism as a major cause of social, environmental, and economic problems. “Companies are widely thought to be prospering at the expense of other communities… (20). Above-mentioned authors have analysed Grameen and Self-Help Group systems and, among other things, concluded, “there is little direct evidence as to whether SHG or Grameen system is more effective at reaching the poorest people”.

In this context the real question is: how much social objective is compatible with a sustainable intervention? The answer may be expressed with a mathematical function where social performance is dependent from the below variables.

Social performance =F (Enterprise Development; Family Income; Food Aid) |

In this scenario the expected performance of whatsoever intervention in any of the three segments shall vary in relation to the relative importance (weight) of the interests, position, expectations of the players and as a result the search of a welding point shall be found out in a continuing negotiation.

Our idea is to have in the field a demarcation line among food aid, income generating activities and enterprise development and apply a different approach while dealing with the credit matters.

At the end of the day, the question is: HOW TO DESIGN A CREDIT MODEL? Twelve years ago, we proposed a new approach based on categorisation of Micro Financial Institutions and proposed to have a distinction among food aid, income generating activities and enterprise development and apply a different approach, while dealing with the credit matters: “Designing a new microcredit model”: https://www.findevgateway.org/paper/2011/01/suggestions-designing-microcredit-model (01/2011). For a better comprehension of the proposed Paradigm, we do recommend going through the above Paper, rated among the first three consulted documents of the year (CGAP).

Then, Basel III Committee on financial inclusion document (2015) issued recommendations for market regulations and supervision and, for the first time, listed together non-finance and finance providers and provided the financial inclusion’s definition, which is as simple as open to any integration: “provision of financial services to unserved and underserved customers”. It should be noted that it refers to customers and not people, which means, in our opinion, that an account with a finance provider should be a precondition to be beneficiary of whatever credit intervention. In this situation, distinctive Actors applying different sources of capitals & means – accompanied by economic policy instruments – should address the Unserved (poor people and excluded from the financial circuits).

Sensibly, the Document made recommendations to national market supervisors to react to the changes and innovations in products, services and delivery channels of financial institutions working with people who do not have an account (Unserved) with a formal financial institution or need (Underserved) to advance it.

In the same line is the definition proposed by FSD Africa “Expansion of a range of financial services to businesses and all sections of society”, along with other organisations that have articulated identical concepts.

The combination of above-mentioned approaches with the outcome of the Financial Services for all known under Banana Skin Survey (2016) on the changing risks sector can produce a synergetic move to achieve the UN Sustainable Development Goals.

In this understanding the success of SDGs become a function of the concerned actors’ capability and willingness to deal with financial and economic inclusion, which have to be conjugated together for having the desirable impact. Indeed, financial inclusion alone could be a disillusion for the provider, an illusion for the client and a likely financial implosion within the community.

Dr. Ascanio Graziosi – Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).

Dr. Ascanio Graziosi – Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).

Featured Image Source: The Conversation/EPA/Nic Bothma