By Ascanio Graziosi – Development Economist and Publicist

We live in uncertain times, with different levels of incertitude. But even in times full of uncertainty, it is possible to plan the future, which is certainly a complex exercise, but not impossible and with a probability of success. Because nothing happens by chance, but everything is linked to a logic of occurrence, as we have investigated with our analysis of the last four decades.

In history there have been traumatised periods by calamities: wars, epidemics, earthquakes, floods and so on, but the day after it was as nothing remarkable had happened, although people tried to learn from the past wrongdoing, with causes and consequences being linked to an unsustainable development process. In this view, the future is the projection of the present, which is the son of the past. If history has any meaning, the planning of tomorrow will have to consider this historical fact.

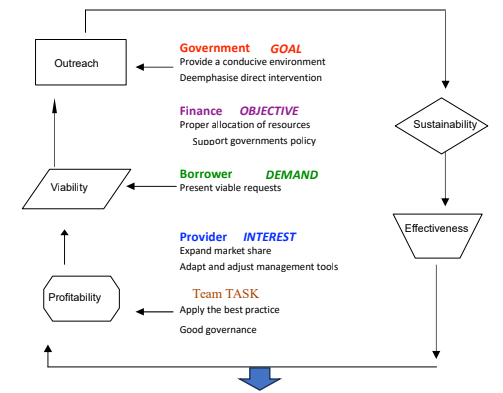

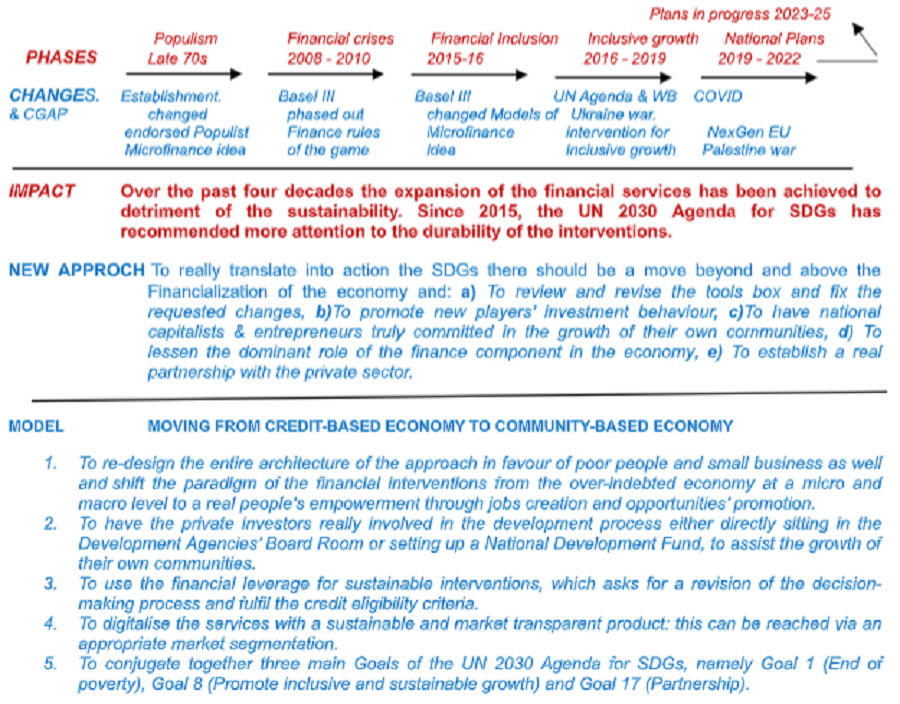

From the top of the below Figure, it can also be understood that the decisions of the Development Actors produced the economic cycles, further to a continuing negotiation in search of a compromise, having different goals, objectives, demand for, and interests on how to meet the inclusive development.

Figure – Connecting the dots of the financial narrative

The Figure also visualises the phases and the changes that generated the rise and the fall of the unsustainable finance and the definitive exit of the populists’ slogan credit for everybody.

The adverse consequences to rely on the successful achievements and stay in stand-by position has been well stated by Nokia CEO while recently announcing the acquisition of the Company by Microsoft “we didn’t do anything wrong, but somehow, we lost”.

By and large, in the market there are three big challenges, namely UNDERCAPITALISATION (need fresh resources to complement inadequate capital), DIGITALISATION (launch sustainable and affordable products in a transparent market) and MANAGEMENT (review style of management and decision-making process).

It is worthwhile to note that the dominant position of the financial component didn’t create new jobs but virtual affluence.

The fundamental question is: Re-start or Re-build, for surviving? Re-think a new point of departure. The task isn’t easy because it asks for expertise above the ground, strong willingness, clear vision, well-defined objectives along with suitable procedures.

Summing up, poor people become the poorest and rich men turn to be richer. Just a figure on the matter: the amount of the money floating around has been estimated (2022) at ten times the value of products/services produced by all UN Members Countries, something like US $ one hundred trillion. Even a small percentage of the above amount can make the difference if invested in the real economy.

However, an IDEA ISN’T A PROJECT because you have to convert it into a venture, starting with a feasibility study going through assumptions, justifications and working out a business plan, the skills and capability of the Businessmen being in line with the job.

As a matter of fact, in the field there are UNSERVED & UNDERSERVED ENTREPRENEURS, UNDERCAPITALISED LENDERS, UNSATISFIED BENEFICIARIES and the question is how to assist them to achieve common objectives and interests.

In this understanding we worked out an Algorithm that consists in reversing the approach from Bottom to Top moving from CREDIT-BASED ECONOMY to COMMUNITY-BASED ECONOMY: a new Development Theory presented in the eBook THE THEORY OF CHANGE APPLIED TO FINANCE FOR DEVELOPMENT

Dr. Ascanio Graziosi – Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).

Dr. Ascanio Graziosi – Owner of Innovative Financial Inclusion Solutions, a financial boutique providing Policy Decision-Makers and Private Clients with advisory services to enable a favourable financial environment and facilitate start-up and growth-up business. Dr Graziosi is a chief player in the arena of economic development. He has collaborated in Sixteen African Countries, out of twenty-four in three Continents, acting as Development Economist on behalf of international funding Agencies (WORLD BANK, FAO, UNDP, WHO, ITALY GVT, DANISH GVT, PRIVATE COMPANIES).