By Xin Wang – President of Charigo Consulting Company and president of the Center for International Economic Cooperation (CIEC), Beijing.

After years of discussions, the enter of force of the Regional Comprehensive Economic Partnership (RCEP), on January 1, 2022, has brought a breath of fresh air to a world full of problems and challenges. For China, and the Asian region, this agreement is very important, while from a global, and future perspective, its significance may be more far-reaching.

Background

In recent decades, the globalized economy has led to a widening gap between rich and poor countries, and between classes in certain countries, and a deepening of international trade frictions. A broad consensus agrees that the future development of globalization in the current way will inevitably lead to more conflicts between countries and more international trade frictions. In addition, the United States and some Western countries use their advantages in the international economic and financial system to sanction other countries and link political agendas, or the so-called security, with normal trade, causing more and more obstacles and uncertainties in international trade. Meanwhile, the WTO is finding it increasingly difficult to deal effectively with these new situations.

Either because of the problems mentioned above, or resisting the influx of capital and products brought about by globalization or others, the FREE TRADE AGREEMENT (FTA) in recent years have become popular around the world, which has significantly changed world trade patterns, and attracted more and more developed or developing countries. This represents, after decades of integration and optimized economic development of various countries, an inevitable fundamental transformation of economic globalization or, we can say, a supplement to globalization.

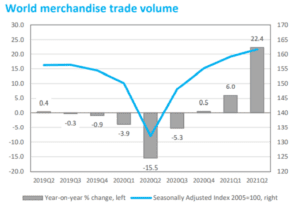

The outbreak of COVID-19 in 2020 made the international supply chain face severe challenges. According to the WTO Goods Trade Barometer released on November 16th, 2021, “merchandise trade volume growth should have slowed down in the second half of 2021. This indication is consistent with the WTO’s most recent trade forecast of 4 October, 2021 which foresaw global merchandise trade volume growth of 10.8% in 2021 followed by a 4.7% rise in 2022.” Meanwhile, the IMF also has lowered its world economic growth forecast for 2021 to 5.9%.

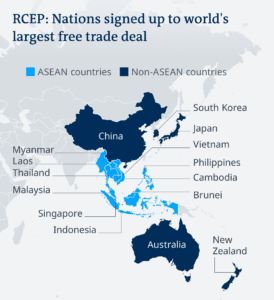

RCEP is the product of such an international environment based on ASEAN + mechanism. It is not much different from other FTAs in essence, but has attracted world-wide special attention because of its scale and position in the world economy, the simultaneous participation of China, Japan and Korea, the present weak economic recovery and uncertain future direction of the world economy.

Introduction to RCEP

RCEP agreement is composed of a preface, 20 chapters (mainly including trade in goods, rules of origin, trade remedies, trade in services, investment, e-commerce, government procurement, etc.), and specific Commitments on Temporary. Movement of Natural Persons. It includes not only market access of goods trade, service trade and investment, but also a large number of rules regarding trade facilitation, intellectual property rights (IPR), e-commerce, competition and government procurement.

1 – An inclusive agreement

RCEP has 15 members, including developed countries such as Japan, developing countries such as Malaysia, and some less developed countries such as Laos. Thus, there are great differences in economic system, development level, economic scale, and trade volume among them, so the agreement fully considers the demands of all parties and establishes a relatively sufficient transition period (the ultimate goal is to eliminate more than 90% tariffs among members in 20 years). Balance of interests in market access and rules on goods, services and investment, etc., and favorable treatment of LDCs are all clearly listed.

In addition, the agreement also has two specific chapters on SMEs and economic and technological cooperation to help developing countries.

2- The largest regional FTA in the world at present

Total GDP ($25.6 trillion in 2019) and population (2.26 billion) account for about 30% of the entire world. In 2019, the trade volume of RCEP members was about $10.4 trillion, attracting FDI of $370 billion, about 30% of the global total again, all of which exceeded the size of other trade agreements, such as CAMUS and the European Customs Union.

3- A comprehensive and mutually beneficial agreement

RCEP agreement covers all aspects of trade and investment liberalization and facilitation, as well as emerging e-commerce, etc. It also formulates rules to support enterprise activities in data transactions.

Considering each member’s different economic and social situation, the agreement adopts principle of flexibility and reciprocity in terms of tax reduction scale and speed. The overall time to meet the final tax reduction requirements is also carried out in stages. Comparing with the CPTPP’s immediate tax elimination rating 90% of all categories, RCEPs tariff cancellation is slow, up to 20 years, and developed ones faster. For instance, Japan’s tax reduction range and time are wider and earlier than those developing countries such as Laos and Myanmar.

4 – The goal is to zero taxes by 91%

According to the agreement, tariffs on 91% of commodities will be lifted in stages in the next 20 years, with the goal of expanding trade in industrial and agricultural products, meaning 91% of products will eventually be tariff free of tariff.

It is undeniable that this agreement, compared to some others like CPTPP which reach nearly 100%, is still less satisfying, but it also means a room to raise its liberalization in the future, and provides a good foundation for other arrangements between countries with strong economic strength such as China, Japan and Korea.

5 – A modern agreement

RCEP is pushing forward the adoption of new technologies to promote customs facilitation and smooth cross-border logistics as well as negative-list commitments in investment access, greatly improving each member’s investment policy transparency.

RCEP also formulates common rules in some 20 fields such as IPR and data circulation, digital information, and data free cross-border circulation. For example, foreign enterprises to enter China will not need to locate their servers in China.

6 – Great breakthroughs in service trade

RCEP makes a more encouraging policy in service trade than WTO’s. On the whole, RCEP members promise to open more than 100 service trade sectors, including finance, telecommunications, transportation, tourism, R&D, etc., and stipulate market access commitment form, national treatment and most favorable nation treatment in service trade among members. This provision reduces restrictive and discriminatory measures affecting cross-border service trade and facilitates the service industries to enter each other’s market.

New business forms and models such as cross-border e-commerce, Internet finance, online office, online education, online consultation, and online trade fair will usher in greater development opportunities. It is expected that service trade, especially after combining with the digital economy, will become a new regional economic growth stimulator.

7 – Rules of production origin

RCEP takes the cumulative rule of production origin, saying all products made from materials or parts from all member countries will be regarded as the original. This rule can cumulatively increase the proportion of original-valued components and make export in the region easier to reach the threshold of tariff preference. In other words, even if producing or processing is finished in multiple countries, tariff preference will still be granted as long as it comes from countries in the region. It’s clear this rule will effectively promote the optimization of regional trade and supply chain, and also a benefit to all consumers. For example, a Thailand company can export its vehicles to Australia with no taxes, even the auto parts from Japan and China.

8 – Others

Modification. RCEP rule says the agreement will be revised every five years, which provides a mechanism for upgrading its future objectives. For example, RCEP has not made clear provisions on labor treatment and environment protection like CPTPP, but it does not rule out future amendments of RCEP.

Supervision and coordination mechanism. RCEP will set up a secretariat that CPTPP did not, which is responsible for collecting enterprise suggestions and complaints, supervising and managing smooth progress of the agreement, etc. In addition, four professional committees and a Ministerial Meeting provides another platform for further consulting.

New members. RCEP promises to be open to new members as long as completing specified procedures.

To sum up, from a global perspective, RCEP is a mechanism with a moderate degree of liberalization, and adopts many categories of tariff abolition in stages. This is an appropriate arrangement considering the specific circumstances of the 15 member states. Not pursue one step, and slow down the process for the ultimate common greater interests, fully reflect the Asian wisdom. With the development of each member, it is believed that RCEP will upgrade its liberal level and expand its scope at the right time as it has the mechanism to make it happen.

RCEP has established a supporting mechanism, coupled with the already mature 10 + mechanism and the East Asia Summit (all member states attend it), which is believed will fully guarantee its smooth operation.

As the world’s largest free trade area highly competitive in the global economy, especially with large economies like China and Japan, RCEP will bring benefits to all countries in the future, because both China, Japan, Korea, Australia, New Zealand and ASEAN all open their arms to globalization and trade and investment facilitation.

Since so, this mechanism will have, more or less, an impact on the global economy, and so will have an impact on the political and economic structures of the region and the world. We can free our imagination for its future.

Impact on the current global economic pattern

Against the background of the continuing impact of Covid-19 and the slow global economic recovery, it is expected that the economic cooperation of the 15 members of the RCEP will not only be conducive to the development of themselves, local and global economic recovery, but also to help economic globalization, regional economic integration and global supply chain reconstruction.

1 – Further promote globalization, multilateralism and free trade, while greatly reverse the trend of unilateralism and protectionism

In recent years, various bilateral, multilateral, regional and cross regional economic arrangements and FTAs have emerged one after another, which is an inevitable choice under international political and economic development in the 21st century. RCEP is the most interesting one in this wave because of its own scale, potential and China. Therefore, it is commented that RCEP is becoming a new focus of Global trade.

RCEP is the region with the largest population and the largest economic and trade scale. According to a UNDP Research Report, the total GDP of RCEP contracting countries accounts for 30.5% of the world, far exceeding that of the North American Free Trade Agreement (28%), the European Union (17.9%), the free trade area of the African continent (2.9%) and the Southern Common Market (2.4%). RCEP’s population and export volume (reaching US $5.5 trillion) also account for about 30% of the world. In addition, RCEP also attracts an average US $360 billion FDI every year, US $440 billion investment to others, accounting for about 1/4 and 1/3 of the world’s total respectively.

RCEP is also the fastest growing region in the world. Over the past five years, the average economic growth rate of the RCEP region has reached 5.2%, far exceeding that of CPTPP (2.2%), EU (2.3%) and USMCA (2.4%), and faster than the global average economic growth rate of 3.4%.

RCEP will also be the region with the most development potential in the world in the future. According to a statistic from the Asian Development Bank, RCEP will generate US $644 billion in global revenue by 2025, and by 2030, RCEP will increase the economy of the region by nearly US $200 billion a year. A study by Peterson Institute for International Economics shows that by 2030, RCEP is expected to drive a net increase of US $519 billion in exports and $186 billion in national income. RCEP rules may become the benchmark and legal precedent of regional free trade cooperation in the future.

So, such a large economic and trade area, its policy direction, views and positions cannot be ignored by any countries or organizations. Its existence and voice will also form a strong containment and influence on the ideological trend of anti-globalization, polarization and trade protectionism. At the same time, it will also strongly promote globalization, opening and liberalization of international trade.

After the release of the news about the official establishment of RCEP, voices from the United States, Europe and other countries and regions generally discuss the challenges and pressures on European and American countries, focus on how to deal with them. However, with the initial noise calming down, how to strengthen competition and cooperation with RCEP countries are becoming the mainstream. For example, Singapore has signed 25 bilateral and regional free trade agreements around the world as of February 2021, a result of RCEP.

2 – Promote economic integration in Asia and the Asia Pacific region

RCEP countries are and will be at a hot area in the global economy. China, Japan, Korea and ASEAN countries are the most competitive countries in the global manufacturing industry and core part of the global industrial chain. In recent years, China, Japan and Korea’s new technology industry brought by IT and biochemical progress is in a leading position in the world, and China has increasingly become a major international market for science and technology and electronic products, raw materials and consumer goods.

RCEP lays a foundation for Asia-Pacific economic cooperation. Although the APEC has been established for decades, a relevant economic cooperation mechanism is still a castle in the air. Now RCEP brings most of APEC countries into one mechanism, and has the first step forward to closer regional economic cooperation in East Asia, Asia and the Asia Pacific.

Economic integration in the region will be greatly speeded up. Before RCEP, China, Japan, South Korea, Australia and New Zealand have signed 10+1 FTA with ASEAN respectively, but RCEP is not just a simple merger of five FTAs. Firstly, wider coverage. This agreement has far broader contents than the general free trade agreement between countries. Secondly, more integrated. The content and coverage are not only bilateral, but also better solve the multilateral trade problems involving third and fourth countries, especially for strengthening the construction of regional industrial chains, which often involves multiple countries. After RCEP, some projects, deals or investments can be realized within the region, and multinational businesses can be considered and more easily put into practice. Thirdly, more institutional. Although the economic cooperation between countries in the region has been very close, their agreement can only deal with trade issues between countries, lacks a systematic institutional system and thus, appears scattered. RCEP is a comprehensive arrangement with higher institutional integrity, more functional working and administration mechanisms, as well as more legal authority.

RCEP has a stronger governance plan. Chapter 18 of RCEP agreement indicates the Minitrial Meeting, four committees in goods trade, service trade, investment, sustainable development and business environment, as well as a permanent secretariat for the daily affairs. In addition, RCEP will have a dispute settlement mechanism. This clearer division management functions will help settle any future problems and disputes, coordinate economic policies among its members, and promote regional continuous in-depth opening. We’ll see a profound structural transformation in some members in the coming years.

RCEP will promote capital flows within the region. As a result of RCEP institution requirements, its members will push administration reforms and improvement, a more transparent and fair business environment will come into being, investment between member countries will increase significantly, bringing more cutting-edge technologies and employment opportunities to ASEAN. Similarly, investment outside the region will increase, too.

Intraregional trade will soar, benefiting all the members. The greater economic benefits of RCEP come from participation of these countries with higher average tariff rates. According to the statistics of the WTO, average tariff rate nowadays, including agricultural and industrial products, Korea (13.6%), China (7.5%), Vietnam (9.5%) and Indonesia (8.1%) are at relatively high levels. The tariff elimination rate of RCEP by category finally reaches 91%, although it was lower than 99% of that of CPTPP, but the Japanese government estimated that the effect of pushing up GDP will be about twice that of CPTPP.

A report released by UNCTAD in December 2021 said, the intraregional trade volume of RCEP will expand by 2%, or about US $42 billion, of which the effect of changing trade objects from outside to inside is about US $25 billion, and new trade within the region is about US $17 billion. The report also believed that due to the tariff reduction, Japan would benefit the most among the members, and its exports to other 14 countries will increase by 5.5% compared with 2019, especially Japan’s auto parts, steel and chemical products.

According to the Peterson Institute in America, RCEP members will drive the annual net export increase by US $519 billion in 2030 and the annual net income increase by US$186 billion. According to information from China General Administration Customs on December 29, 2021, in the first 11 months of 2021, the total China’s imports and exports to 14 other RCEP member countries valued 10.96 trillion RMB yuan, 31% of China’s total foreign trade volume.

The strong economic resilience and upward momentum of this region indicates, just as the UNCTAD report says, “it is relatively less susceptible to COVID-19.” In fact, in 2020 and 2021, this region became the world’s largest manufacturing base and made a large contribution to the world economy.

Service trade and the digital economy will see rapid development. WTO data shows the total volume of world service trade reached US $12 trillion in 2019, with an average growth rate of 5.4% from 2010 to 2019, significantly faster than that of goods trade, while the rate of service trade growth of RCEP 15 countries was 7.8 %.

In service trade, Japan, Korea, Australia, Singapore, Brunei Darussalam, Malaysia and Indonesia promise to adopt a negative-list mechanism, and China and others would convert from positive-list to negative-list before 2028.

Frankly speaking, compared with its goods trade, service trade in the RCEP region is still in a growing period. In addition to the expansion of digital technology and products, China and Japan have become more active global financial players.

In 2019, China’s total cross-border e-commerce transactions reached 10.5 trillion RMB yuan, with an average annual compound growth rate of 22% from 2013 to 2019. The proportion of cross-border e-commerce in China’s imports and exports of goods also increased from 12% in 2013 to 33% in 2019. Considering that the e-commerce between China, Japan and Korea and ASEAN countries is still in the expanding stage, geographically close to each other and similar consumption habits, there will be great space in the future whenever more convenient logistics and customs clearance, as well as further tax reduction are gradually realized.

It is certain that the growth rate in RCEP service trade will be more than 8% in the next five years, especially after the epidemic ends, tourism, people to people and cultural exchanges, education will explosively grow.

China-Japan-Korea FTA is becoming much more possible. At the China-Japan-Korea Summit in 2002, a FTA proposal was put on table for the three countries with a population of more than 1.5 billion, wishing to lift all tariffs and other trade restrictions, and smooth the flow of goods and other materials, and so to reduce manufacturing costs. However, Japan was unwilling to open its agricultural market, South Korea didn’t want to open its automobiles and household appliances market, and China hesitated to open its financial market of other service industries, and coupled with the problems left over by history, differences in values and unhappy national feelings between the three major economic powers, especially the constant interference of the United States, this proposal has been still in a slow progress in past 20 years.

The United States has never wanted to see a closely related Asia, nor did it want to see China, Japan and South Korea economically integrated. For decades, American administrations have exhausted various means to obstruct the progress of the China-Japan-Korea FTA. The Obama administration was determined to return to Asia and began to establish TPP in order to grasp economic leadership in Asia while isolating China, and forming new interference with the China-Japan-Korea FTA.

Although RCEP is not liberal enough, it still, for the first time in history, enables China and Japan to reach a bilateral tariff concession arrangement, partially intensify trade relationship among China, Japan and Korea, and brings opportunities for the three countries to realize their FTA in the future, because they share common interests and on the other hand, the increased running in and understanding in the process of realizing RCEP give the three countries an excellent chance move forward based on this agreement for their higher-level mechanism.

China, Japan and Korea are the world’s second, third and tenth largest economies respectively. China is Japan’s largest trading partner, and Korea is the third. At present, the average import tariff from China to Japan is 25%, and 41.1% from Korea. Some ten years later after the implementation of RCEP, Japan, China and Korea will cancel tariffs on about 70% categories of products. Although the degree is not satisfying, it can still promote their economic aggregation. China, Japan and Korea have their own advantages in the digital economy, and there is a great demand for various kinds of business cooperation. China, Japan and South Korea officials, encouraged by RCEP, agreed that they would speed up the negotiation for their own free trade agreement to further contribute to the regional and world economic recovery.

In fact, China, Japan and Korea have long been aware of the benefits of FTA for themselves and have not given up their efforts. While RCEP is still in the negotiation process, the 7th China-Japan-ROK leaders’ meeting held in Japan in May 2018 issued a joint declaration, reiterating to further accelerate the negotiation and strive to reach a comprehensive, high-level, mutually beneficial and valuable FTA. In April 2019, the 15th round of chief negotiators’ meeting had an in-depth discussion on important issues in goods and service trade, investment and rules, and agreed to further improve the level of trade and investment liberalization and incorporate high-standard rules on the basis of RCEP, or we can call it as RCEP +.

From this perspective, it’s reasonable to say RCEP is a historic achievement and breakthrough for Asia.

3 – Influence and significance for Japan

Japanese exports will benefit a lot from RCEP. For Japan, RCEP is estimated to boost Japan’s exports to the region by more than 5% over 2019. The Japanese government estimates that the agreement will boost Japan’s GDP by about 2.7%, surpassing the CPTPP (about 1.5%). The proportion of Japan’s non-tax categories to China will be increased from 8% to 86% and to Korea from 19% to 92%.

Japan’s industrial chain layout has more options, and Japan’s businesses will speed up entering Southeast Asia and China. Over the past decades, the Japanese government has attached great political attention to Southeast Asia, provided various kinds of aid, and maintained good diplomatic and economic relations with the region. For example, from 2002 to 2012, Japan’s aid to Southeast Asia generally showed a steady upward trend, and reached a peak in 2012, about US $4.182 billion. In December 2019, the then foreign minister of Japan promised to provide ASEAN with a total of US$3 billion worth of loans and funds, of which US $1.2 billion came from the Japan International Cooperation Agency (JICA).

Japanese enterprises have been cultivating in ASEAN for various reasons other than historical ones. From 2011 to 2013, Japan was the second largest investor to ASEAN (the EU was the first), totaling US$56.39 billion, 16.9% of overall FDI ASEAN won. In 2013, Japan’s FDI increased by 10.4% over 2012, reaching US $135 billion. By the end of 2013, manufacturing investment accounted for 58.8% of Japan’s investment stock in ASEAN, mainly involving automobile, electronics, machinery and chemical industries.

The Japan ASEAN FTA Agreement started in April 2017 and immediately implemented zero tariffs on 90% value of products from ASEAN. ASEAN is gradually reducing import tariffs from Japan, 85% of the products will adopt zero tariffs within 18 years after 2017. This is another step and opportunity for Japan to transfer its productivity to ASEAN countries, its scale and amount far exceed China’s investment in ASEAN.

RCEP agreement, as mentioned earlier, is a regional agreement connecting Japan, China and ASEAN. Its rules, such as the principle of origin, give Japanese enterprises new opportunities for industrial chain layout. For example, some processing and assembly enterprises located in China have been transferred to ASEAN due to rising labor and land costs or other reasons in China, while hi-tech components will be kept in Japan, and some cannot be moved away temporarily will be left in China. Therefore, it can be expected that the investment of Japanese enterprises in ASEAN will increase significantly in the next 3-5 years without affecting the export to the Chinese market.

With the same logic and conclusion, Korean enterprises will have similar actions.

Japanese enterprises’ trade in goods and services to China will increase. Moving to ASEAN does not completely mean China is losing its attraction to Japanese enterprises. According to a Japan media survey recently, 70% of Japanese enterprises believe that under RCEP arrangement and gradual decline of China-Japanese tariffs, they should continue to strengthen business with China, especially to expand service trade such as finance and e-commerce, as well as new technology products that China badly needs.

So, in general, the era of large-scale transfer of manufacturing industry from Japan to China in the 1980s and 1990s is happening again in Southeast Asia, where it will become the main manufacturing bases for Japanese and Korean enterprises in the future. Due to the increasingly close economic connection between China and Japan, technological progress of China and the continuous expansion of the Chinese market, the economic activities between China and Japan are more in new technology, finance, and other fields. Japanese enterprises will pay more attention to sell their products into the Chinese market, including consuming goods.

4 – A new choice for future global industrial structure adjustment

RCEP regional economic connection and industrial chains will be further integrated. In the past 30 years, as a result of increasingly more and more investment from multinational enterprises and between each other, East Asian regional economies have been well connected, forming a relatively complete regional industrial chain. Now, China becomes the core factor, either because of its positive attitude towards regional cooperation, its industry and market scale, complete manufacturing structure, or its increasingly bigger and bigger market. Now it’s natural to manufacture a complete product in several countries, such as in Japan (Europe, America, or Korea), China and Southeast Asia, and then assembled and sold back to China or other countries (Apple cellphone is a good example). RCEP principle and aims add institutional guarantee to this model in this region, with additional economic efficiency and policy transparency. This naturally will further accelerate and strengthen the countries’ economic interaction and industrial chains in the region.

What’s more, RCEP further enables member states to enter global supply chains through their respective industrial advantages, trade channels, and further lengthen and strengthen the industrial chains of ASEAN + China, Japan and South Korea.

RCEP will attract and keep more Japanese, Korean and western enterprises in the RCEP region. The current Covid-19 and changes of international situation have brought international community’s concerns and readjustments about the safety of the industrial chain. In the past 10 years, China’s land and labor costs have increased significantly, plus pressure from the US, some Japanese, Korean, American and European Union enterprises have transferred some or all of their manufacturing capacity from China to motherlands, to its neighboring countries or ASEAN countries such as Vietnam. Now, RCEP tax and unified rules of origin as well as others will attract and encourage multinational companies to establish and maintain their supply chains in RCEP region, they (especially those from Europe, Japan and Korea) have greater flexibility in dealing with the complicated situation between China and the United States. More European, American, Chinese, Japanese and Korean multinational companies will comfortably stay in Asia to avoid the tariff imposed by the U.S. government on China-made goods, enter the markets of 15 countries through this regional industrial chain, or establish a connection with the global market through existing international trade mechanisms in these countries.

RCEP will greatly promote the transfer of enterprises in China to ASEAN. This trend is a result of economic development in China and changes in the international industrial structure, and also a simple and effective way for enterprises in China (Chinese and foreign-funded firms in China) to avoid American and some European countries’ policies against Chinese products.

In fact, the remarkable increase of trade and investment between China and ASEAN in the past five years happened among multinational corporations (including Chinese ones) in this area partly because of lower costs in ASEAN, partly because of the unfavorite policy adjustment to China-made products, and partly because of numerous FTA mechanisms ASEAN countries have with other countries.

Now RCEP comes, the trend, without any doubts, will continue, expand, and speed up.

RCEP will further link its countries with resource countries in Africa and Central Asia, etc. China, Japan and Korea are world-wide manufacturing powers either in traditional manufacturing or new technology sectors, and the RCEP region has attracted many European and American enterprises. All together, they need a large share of global natural resources and raw materials. Gradual disappearance of trade obstacles and taxes in RCEP region, and potential expansion of its production chain will stimulate even larger need of various kinds of natural resources, meaning a closer industrial chain with these resource-abundant countries will be in shape too. These resources, not only merely oil or gas, but also coal, different minerals, agricultural products, etc., will involve a huge amount, this means opportunities for some countries in Africa, Middle East, Central Asia and Latin America.

5 – New opportunities and challenges to American and European countries

East Asia countries already have close economic and trade relations between Europe and the US, RCEP will, no doubt, bring a series of changes. Taken together, it is beneficial for Europe and the United States in essence. For enterprises, opportunities and challenges coexist, but opportunities outweigh challenges.

China has long been the most important trade and investment partner of Europe and America. Huge bilateral goods trade volume between China and EU as well as China and US have been seen for years. China has been the largest trade partner of US for years, while according to official statistics of the European Union shows the total import and export volume in 2019 between Europe and China was US$718.18 billion, and even in 2020 when the serious epidemic happened, China-EU trade volume still reached US$649.5 billion, and China also became the largest trading partner of the EU for the first time.

Except for goods trade, according to Chinese figures, the China-EU service trade volume in 2017 also reached US$121.8 billion. From January to September 2021, the bilateral trade volume reached US$599.34 billion, an increase of 30.4%.

Except with EU members, China also keeps close trade and investment relations with other European countries, especially those central and eastern countries as well as with Britain.

The EU and Japan also enjoy good economic and trade relations. Since 2015, Japan’s trade with the EU has shown an overall growth trend. In 2019, the EU accounted for 11.6% of Japan’s exports, while the EU accounted for 21.4% of Japan’s imports. For the EU, Japan is its seventh largest partner, its exports and imports to Japan account for 2.9% and 3.3% respectively. In 2019, the EU-Japan Economic Partnership Agreement (EPA) entered into force, with more than 90% of the tariff canceled. Due to the strong economic homogeneity, similar technical level and small market capacity of Japan, Japan is only the sixth largest trading partner of the EU. However, driven by the epidemic and the new technology industry, the total bilateral foreign trade in 2021 was 1498.6 billion yen, and Japan’s trade deficit with the EU was 135.2 billion yen, an increase of 66.1% year-on-year.

Since 2015, Japan’s FDI to the EU has increased. In 2019, the balance of Japan’s direct investment in the EU was 55.2 trillion yen, accounting for 27.2% of the total balance of its foreign investment, an increase of 4.1 percentage points in four years, only lower than Japan’s investment in the United States. The UK accounts for the largest proportion of Japan’s direct investment in the EU, with 34% in 2019.

RCEP contributes to a more friendly international environment for European and American companies. Firstly, RCEP meets the general trend of international economic development. For years, due to weakness of the governance ability of political parties, increase of international immigrants or refugees, decline of economic competitiveness and economic depression in some countries, the populist thought in Europe has been increasingly fermented, extreme right-wing political parties have been stronger and stronger as more and more support from the middle and lower classes of in some Western countries. American unilateralism since the Trump administration has in turn stimulated the continuous growth of populism and protectionism in Europe.

In this international context, RCEP is conducive to hedging protectionism, curbing anti-globalization thoughts and trends, and creating an open, inclusive, mutually beneficial and win-win international cooperation environment. This will be definitely beneficial to European and American businesses in the end.

Secondly, it is positive for the innovation of future international economic order. This FTA arrangement has received wide welcome from many European and American enterprises, believing it an important contribution to free and rule-based world trade structure, a new impetus for integration and reorganization of global resources. Experts from developing countries think it will accumulate experience for the reform of the world trading system and the revitalization of developing countries in the future.

The current international economic system was formulated under the leadership of European and American countries decades ago, but in the past two decades it has encountered many problems because it cannot adapt to the general trend of world economic development, especially the rise of emerging countries like China, Turkey, Korea, Indonesia, etc. A nonfunctional world economic system is also harmful to fundamental interests of European and American enterprises.

Thirdly, the European economy before the epidemic was already very weak, and Americans were facing numerous challenges. At present, various problems in the global supply chain have seriously affected America, Europe and the economies of the world. RCEP will reinforce the industrial chain combination of in the region, an opportunity for European and American enterprises.

RCEP rules and perspectives are favorable for European and American enterprises to expand their business in the region, reduce costs and improve competitiveness. With a vast territory, a large population, rich resources and full of entrepreneurship, the region will become the most active part of a new world economy and governance structure, a historical chance for many European and American enterprises.

In the future, the less developed countries in the region have to improve their management, professionalism and market norms in international economic cooperation, which is also beneficial to the existing and future economic activities of European and American enterprises. In addition, RCEP rules provide another stronger guarantee for the landing of European capital investment.

Bernd Lange, Chairman of the International Trade Committee of the European Parliament, said: “if the agreement can create a barrier free supply chain and promote cooperation among its member states, European enterprises in the region will surely benefit from it. Actually, the EU has signed bilateral agreements with many RCEP members, so it will improve our economic relations with Asia.”

Other opportunities for European and American enterprises. Countries in the region hold the same open attitude towards investment and trade with Europe and America, their further improvement of technological level of the local enterprises will generate more requests of materials, technology and further investment. In addition, after the economic development in the region, there is bound to be a demand for financial, legal or consulting services, which is the strength of European and American businesses. Increase of people’s income in the region will need new and more consuming products (such as the journey China had in the past 20 years).

Actually, the EU and the United States have signed free trade or other agreements with Japan, Singapore, Vietnam, etc. China and the EU are trying to reach their investment agreement. So, European and American enterprises can indirectly obtain the fruits of the economic development of countries in the region.

Of course, more pressure on Europe and America will come. RCEP brings China, Japan and Korea economically closer. Three economic giants of strong economic power, financial and technological abilities, a big challenge to European and American companies. Profound and mature relations in RCEP members will also change the current international economic landscape. “The signing of RCEP shows that the EU must continue to actively adopt trade policy measures,” said Reinhard Bitikofe, a green party European parliamentarian and China expert.

The first important manifestation of pressure is the outlet to the RCEP area. Because of the tax reduction and convenient channels in RCEP region, coupled with the existing advantages in manufacturing capacity and human resources, it is self-evident that under the same or similar conditions, enterprises in RCEP countries will give priority to do business with ones in the same framework. Therefore, it is expected that some imports from countries outside the region such as the United States and Europe will be replaced by member countries. Of course, since full RCEP implementation still needs years, some member countries already have some kind of FTA with Europe and the United States, and most enterprises usually have the inertia of previous cooperation, this situation won’t happen immediately, but the trend is true.

The second manifestation of pressure is competition in the international market. RCEP will further expand the advantages in productivity, costs and efficiency, more competitive to enterprises in Europe and US. The outward investment from Europe and the US will also take away their domestic employment opportunities. Holger Bingmann, President of the German Branch of the International Chamber of Commerce (ICC), commented that the strategic significance of this economic area, which will surpass the EU in a few years, is extraordinary. “The EU must ask itself what kind of future vision we have, and we need to speed up the pace.” He believed the EU must speed up its FTA progress with some countries as soon as possible. The slow free trade negotiations of the “Southern Common Market” composed of the EU and five South American countries have also been criticized.

The third pressure is on the future world economic order. China, Japan and Korea, three influential world economic powers, now are combined with Australia and New Zealand that are very familiar with Western rules, not to mention ASEAN, an important player in regional and global governance. For their common interests, RCEP countries would have one voice in some world economic issues, then, that will be a major challenge to Europe and America which have dominated the existing order for decades. Jürgen Hardt, foreign policy spokesman of the ruling CDU/CSU Bundestag Party in Germany, said that the agreement must be regarded as “a wake-up call for Europe”. The EU cannot hesitate its free trade course, “otherwise other countries will set standards and let Europeans fall behind”.

6 – For other countries and regions

A competitive investor. China, Japan and Korea have abundant capital, foreign investment capacity as well as strong competitiveness in their respective technical fields, which are attractive to most developing countries. If China-Japan-Korea FTA or in-depth cooperation can be established based on RCEP, the three countries will have a strong competitive advantage over Europe and the United States in high, medium or low-level technology output and foreign cooperation in various fields. ASEAN itself also has a remarkable number of large and international enterprises with mature funds and management, another strong international investor.

Compared with Europe and the US, China, Japan, South Korea and ASEAN countries have few additional conditions for foreign investment, and Asian business culture, focusing more on the future, win-win cooperation and efficiency, are also obviously more competitive. Coupled with the spirit of hard work, Asian companies have more prominent advantages.

A huge market temptation. Most countries in the RCEP region are production-oriented and need to import huge amounts of raw materials or relevant supplies. For example, China is the NO.1 buyer of most raw materials, China and Japan are two world major importers of oil and gas. Another example, enterprises in the region have strong demand for raw materials such as iron ore and copper, which is also a great opportunity for many Latin American and African countries.

China, Japan and Korea themselves have large domestic market demand. Most of ASEAN countries have a dramatic number of middle-class, and also have relatively high consumption capacity. RCEP now provides access to the regional market via one country to RCEP, even from RCEP to the international market.

Comfortable entry threshold. A majority of RCEP members are developing countries, as described earlier, the agreement takes care of all parties as much as possible, and the entry conditions are relatively comfortable compared with other FTAs. Over time, RCEP’s open architecture will attract new members, especially developing countries, such as Pakistan, Bangladesh and Maldives in South Asia and some central and West Asian countries in the next 3-5 years.

All in all, RCEP will further push forward progress of new globalization and global governance, and help economic recovery from the Covid-19. It is an opportunity for most countries and enterprises, as well as a challenge to countries in and out of the region, especially for Europe and the US.

RCEP will grow up and become mature in the next 2-3 years, and then we will see a more dynamic economic zone and unimaginable outcomes.

The key to the success of RCEP is how to avoid the interference of political and external factors. For final success, China, Japan, two largest economies in the region, play fundamental roles.

How much RCEP will bring to the region or world, and how much it could push the China-Japan-Korea FTA come into being, are interesting topics. Next two years, we will see it.

Author: Xin Wang (President of the privately owned Charigo Consulting Company in Beijing and president of the Center for International Economic Cooperation (CIEC) founded by Mr. Xin Wang, together with former ambassadors, well-known Chinese scholars and business leaders. Mr. Xin Wang was previously a vice president of the Center for China and Globalization in Beijing, president of the Sinomedia International Group in San Francisco, and president of the Training Center of the China International Publishing Group. Charigo is also a consulting firm that helps international businesses to explore the China market and to understand better China’s policy making and government. It also assists Chinese companies in investing overseas).